The new year brings new domain name opportunities and challenges. Definitely 2023 saw a mix of both.

This article is not about resolutions, but it is about reflecting on the past year, and setting the stage for the new one. Reflection is a helpful exercise in most things, and domain investing is no exception.

1. Unexpected Sales

Did you sell names during the year that you honestly thought were unlikely to ever sell? Review your sales, and make a list of those that fall into this category.

Reflect on those, and consider whether there is a message, or are they really just outlier sales. Decide what actions, if any, you plan.

2. Disappointments

What were the biggest disappointments in domaining during 2023? Did you have substantial holdings in a niche or extension with few or zero sales? Do you just want to liquidate, or do you feel the problem was where they were listed or how they were priced?

Are there habits that you want to change? Perhaps you want to strive to acquire fewer, but higher quality, names?

3. What Did You Miss Out On?

What opportunity in 2023 do you regret missing out on? For example, personally I did not acquire any .ai names, and with the superb year the extension had, certainly feel some regrets.

Think about why you missed out on that opportunity? Was it not staying up with the latest trends? Perhaps, it was a sector or niche that you don’t understand? Or was it because investment would have been outside your risk tolerance comfort zone?

As the article Catching Trains and Avoiding Train Wrecks noted, there can be good reasons to stay on the sidelines, and no investor needs to participate in all opportunities.

4. Annual Accounting

One step at year end should be to take a look at profitability. This is a good time to calculate gross and net sales, as well as the amount that you spent for acquisitions, transfers, renewals and for subscriptions and other services. If you use monetized parking, also calculate that.

Unless your portfolio is very small, or inactive, it is probably best to keep these in a spreadsheet throughout the year, so you simply have to look at the totals. The topic of portfolio record keeping was covered in the NamePros Blog a few years ago: Portfolio Record Keeping.

5. Portfolio Revenue Per Domain

A useful simple indicator of success is the average annual revenue per domain in your portfolio. It is easy to calculate – simply take your revenue from domain names, and divide by the number of domain names in your portfolio. I introduced the calculation in this article: Dollar Volume per Domain Listing (DVPL).

If your DVPL is less than the acquisition/holding costs of your domain names it should be a warning sign. An increasing DVPL from year to year is a signal of improving portfolio quality.

Of course you can make other calculations, such as portfolio sell-through rate or average price, but I think the DVPL is a simpler and more comprehensive number.

6. Learn Something New

To be successful in domaining you need to be well-informed, and that means constantly learning new things. If you could pick only one, what do you plan to learn during 2024?

7. Twenty Most Valuable Domains

Domains are not created equal. Recognizing the most valuable domain names can help you in terms of priorities for your time and in pricing decisions. I know this one is harder than it at first seems, but make a list of your top 20 domain names. If you also did this a year ago, compare the two lists.

8. Liquidation List

What are the domain names you absolutely want to eliminate from your portfolio? Why not make a list of the 20 you are most sure about, and decide how you plan to liquidate them. This NamePros Blog article has suggestions on that topic: Liquidate Domain Names Or Not.

9. Learn A New Tool

While domain investing is an art, and instincts developed by experience are important, metrics and data can help inform and validate decisions. The NamePros Blog regularly covers tools and metrics. Also the What Happened In Domains In 2023 includes many possibilities. Why not set a goal of becoming more proficient with one additional tool or resource?

10. Try A New Selling Platform

We have choices when it comes to where we list our names for sale. They can be on the main general purpose marketplaces, or brandable marketplaces, or one of the smaller marketplaces, our own website, or a managed portfolio service.

The landscape is constantly changing, with altered commissions, new features, and new places to potentially list names. Why not make a decision to try something new for a portion of your portfolio?

11. Find Better Life Balance

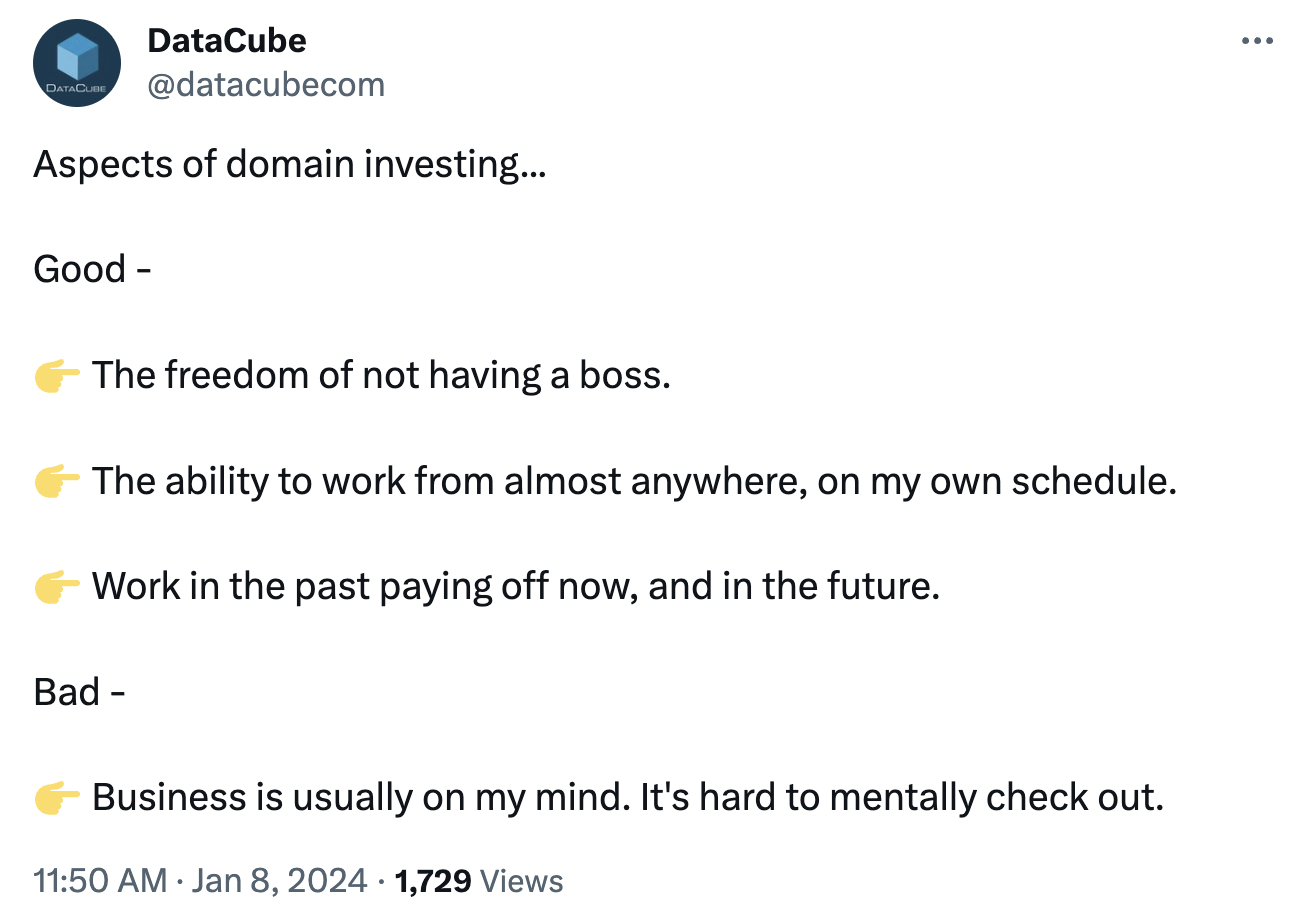

On X the other day @bmugford posted the following about the pros and cons of domain investing.

I think it perfectly summarizes both the opportunity, and the challenge, of domain investing. Take advantage of the flexibility re time and location offered by domain investing if you do this full time. But also take steps to not allow domain activities to command all of your time.

This might be the closest thing on this list to a resolution. Whether it is more time with family and friends, travel, exercise or something else, make sure that you find the balance that is right for you.

Some years ago @James Iles wrote on exactly this topic: Should You Take A Break From Domaining? A few years later I also considered Time For A Break From Domain Names.

Whether it is chasing expired auctions or closeouts, or hand registering, domain acquisitions can easily become addictive. Sometimes the best way to control that is to take an acquisition break.

12. Why Am I In Domain Investing?

I think it is worthwhile to periodically ask the big question: Why exactly am I in domain investing? Is it strictly related to financial return? Or perhaps you find naming, branding and domain names fascinating? Or do you like the challenge? Do you have a specific contribution that you hope will change for the better some aspect of company naming?

Thanks

I hope that 2024 will be a successful and rewarding year for each of you. Thank you for your participation in the NamePros Blog throughout the year, adding comments that extended and enriched the articles, and for your encouragement through leaving likes, thanks or comments, or simply viewing the articles.

Looking for a more in-depth article on the value of reflection, and how to go about it? I found this article from Harvard Business Review by James R. Bailey and Scheherazade Rehman helpful: Don't Underestimate The Power Of Self Reflection.

I invite readers who feel so inclined to share below their reflections on the last year, and their plans for 2024.

This article is not about resolutions, but it is about reflecting on the past year, and setting the stage for the new one. Reflection is a helpful exercise in most things, and domain investing is no exception.

1. Unexpected Sales

Did you sell names during the year that you honestly thought were unlikely to ever sell? Review your sales, and make a list of those that fall into this category.

Reflect on those, and consider whether there is a message, or are they really just outlier sales. Decide what actions, if any, you plan.

2. Disappointments

What were the biggest disappointments in domaining during 2023? Did you have substantial holdings in a niche or extension with few or zero sales? Do you just want to liquidate, or do you feel the problem was where they were listed or how they were priced?

Are there habits that you want to change? Perhaps you want to strive to acquire fewer, but higher quality, names?

3. What Did You Miss Out On?

What opportunity in 2023 do you regret missing out on? For example, personally I did not acquire any .ai names, and with the superb year the extension had, certainly feel some regrets.

Think about why you missed out on that opportunity? Was it not staying up with the latest trends? Perhaps, it was a sector or niche that you don’t understand? Or was it because investment would have been outside your risk tolerance comfort zone?

As the article Catching Trains and Avoiding Train Wrecks noted, there can be good reasons to stay on the sidelines, and no investor needs to participate in all opportunities.

4. Annual Accounting

One step at year end should be to take a look at profitability. This is a good time to calculate gross and net sales, as well as the amount that you spent for acquisitions, transfers, renewals and for subscriptions and other services. If you use monetized parking, also calculate that.

Unless your portfolio is very small, or inactive, it is probably best to keep these in a spreadsheet throughout the year, so you simply have to look at the totals. The topic of portfolio record keeping was covered in the NamePros Blog a few years ago: Portfolio Record Keeping.

5. Portfolio Revenue Per Domain

A useful simple indicator of success is the average annual revenue per domain in your portfolio. It is easy to calculate – simply take your revenue from domain names, and divide by the number of domain names in your portfolio. I introduced the calculation in this article: Dollar Volume per Domain Listing (DVPL).

If your DVPL is less than the acquisition/holding costs of your domain names it should be a warning sign. An increasing DVPL from year to year is a signal of improving portfolio quality.

Of course you can make other calculations, such as portfolio sell-through rate or average price, but I think the DVPL is a simpler and more comprehensive number.

6. Learn Something New

To be successful in domaining you need to be well-informed, and that means constantly learning new things. If you could pick only one, what do you plan to learn during 2024?

7. Twenty Most Valuable Domains

Domains are not created equal. Recognizing the most valuable domain names can help you in terms of priorities for your time and in pricing decisions. I know this one is harder than it at first seems, but make a list of your top 20 domain names. If you also did this a year ago, compare the two lists.

8. Liquidation List

What are the domain names you absolutely want to eliminate from your portfolio? Why not make a list of the 20 you are most sure about, and decide how you plan to liquidate them. This NamePros Blog article has suggestions on that topic: Liquidate Domain Names Or Not.

9. Learn A New Tool

While domain investing is an art, and instincts developed by experience are important, metrics and data can help inform and validate decisions. The NamePros Blog regularly covers tools and metrics. Also the What Happened In Domains In 2023 includes many possibilities. Why not set a goal of becoming more proficient with one additional tool or resource?

10. Try A New Selling Platform

We have choices when it comes to where we list our names for sale. They can be on the main general purpose marketplaces, or brandable marketplaces, or one of the smaller marketplaces, our own website, or a managed portfolio service.

The landscape is constantly changing, with altered commissions, new features, and new places to potentially list names. Why not make a decision to try something new for a portion of your portfolio?

11. Find Better Life Balance

On X the other day @bmugford posted the following about the pros and cons of domain investing.

I think it perfectly summarizes both the opportunity, and the challenge, of domain investing. Take advantage of the flexibility re time and location offered by domain investing if you do this full time. But also take steps to not allow domain activities to command all of your time.

This might be the closest thing on this list to a resolution. Whether it is more time with family and friends, travel, exercise or something else, make sure that you find the balance that is right for you.

Some years ago @James Iles wrote on exactly this topic: Should You Take A Break From Domaining? A few years later I also considered Time For A Break From Domain Names.

Whether it is chasing expired auctions or closeouts, or hand registering, domain acquisitions can easily become addictive. Sometimes the best way to control that is to take an acquisition break.

12. Why Am I In Domain Investing?

I think it is worthwhile to periodically ask the big question: Why exactly am I in domain investing? Is it strictly related to financial return? Or perhaps you find naming, branding and domain names fascinating? Or do you like the challenge? Do you have a specific contribution that you hope will change for the better some aspect of company naming?

Thanks

I hope that 2024 will be a successful and rewarding year for each of you. Thank you for your participation in the NamePros Blog throughout the year, adding comments that extended and enriched the articles, and for your encouragement through leaving likes, thanks or comments, or simply viewing the articles.

Looking for a more in-depth article on the value of reflection, and how to go about it? I found this article from Harvard Business Review by James R. Bailey and Scheherazade Rehman helpful: Don't Underestimate The Power Of Self Reflection.

I invite readers who feel so inclined to share below their reflections on the last year, and their plans for 2024.