This report is based on 145,100 domain name aftermarket sales recorded for 2023 on NameBio, with a total dollar volume of just over $139 million USD.

The domain name market, at least as reflected in the NameBio data, was down 21.2% in dollar volume when 2023 is compared to 2022.

Not only was the dollar volume down when compared to the previous year, 2023 was the second lowest of the past five years, with only 2020 lower. That year had $119 million in sales.

The data was captured just after the close of the year. While some sales for the year get reported late to NameBio, by using a consistent procedure from year to year, the trends should not be biased.

Many sales, particularly retail sales, are not reported in NameBio. They may be from venues with no reported data, unreported private sales, or sales subject to NDA. Almost all registries no longer report registry premium domain name sales.

A higher percentage of wholesale transactions than retail are recorded in NameBio. While the number of sales is dominated by the wholesale transactions, the dollar volume is primarily influenced by the significant retail sales. The total dollar volume is probably the best indicator of overall strength, and is the focus of this report.

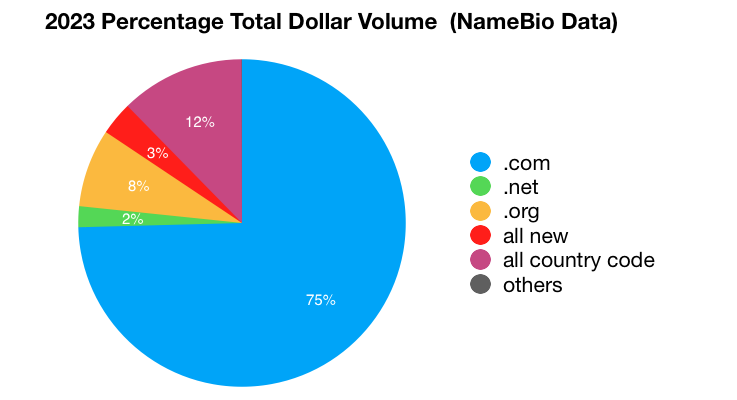

Three-Quarters Domain Pie Due To .COM Sales

If you restrict domain investing to just .com, about how much of the market are you overlooking? It turns out roughly 25%. 75% of the total dollar volume in 2023 was from a single extension, .com. The graph below shows how the entire pie is divided.

While .com dominates 2023 sales, it has slipped compared to 2022, when 81.4% of dollar volume was .com. Country code extensions and .org both increased their dollar volume share in 2023.

.COM

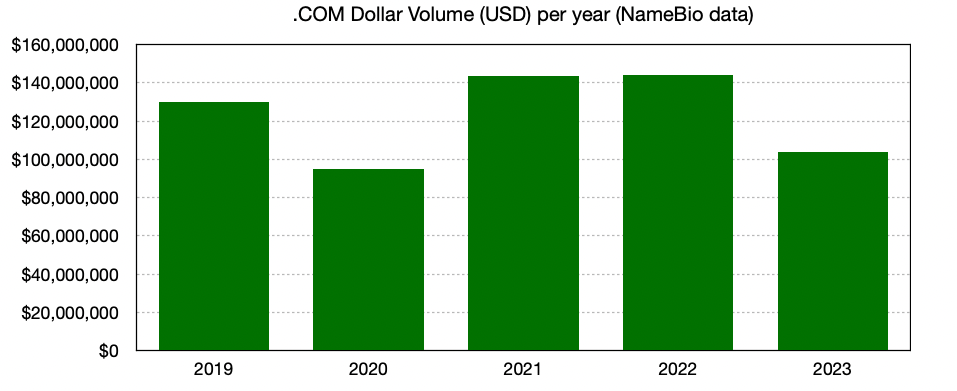

Dollar volume in .com was down 27.9% when 2023 sales are compared with 2022.

The graph below shows the dollar volume for .com by year. While 2023 was slightly better than 2020, a year with a sharp dip during the early months of the global pandemic, it was weaker than the other three years.

The pandemic induced shift to online transactions resulted in 2021 and 2022 being among the best years for domain investment.

.NET

The .net extension did slightly better relative to .com, but still suffered a 10.4% drop in dollar volume when 2023 is compared to 2022. It should be kept in mind that .net had dropped 25.4% in 2022 as well.

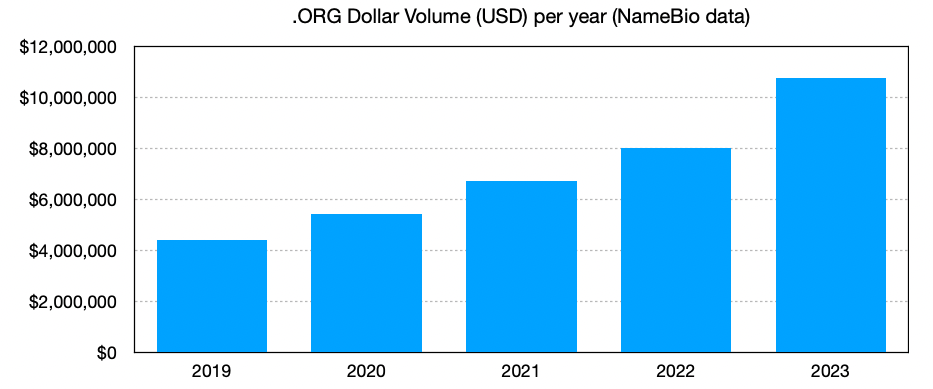

.ORG Most Consistent Growth

The .org extension is on a modest but steady increase, and that continued in 2023. When we compare 2023 with 2022, the .org sales dollar volume was up 34.4%. As we see below, there is a consistent growth pattern over the last five years.

The .org sales volume, $10.8 million in 2023, is much higher than .net, $2.9 million.

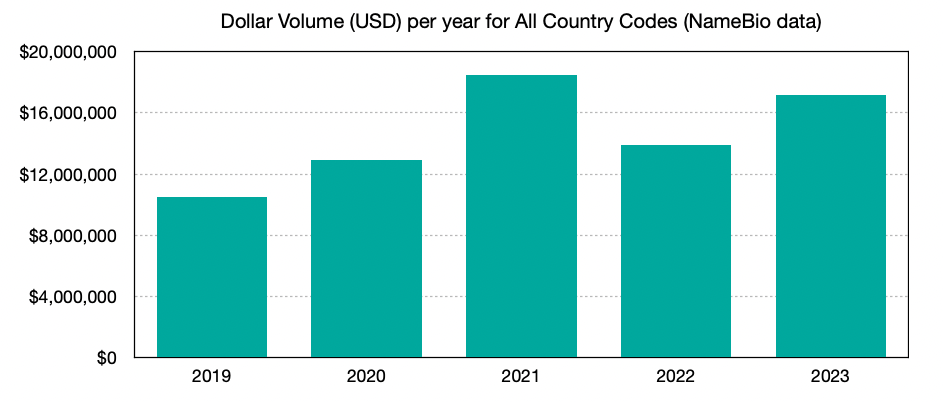

Country Code Extensions Perform Well in 2023

Country code extensions, after very strong years in 2020 and 2021 on the back of .io and .co, had suffered a pullback in 2022. But in 2023 country code extensions as a whole saw a 23.5% increase in dollar volume compared to 2022. During 2023 country codes accounted for just over $17.1 million in NameBio-reported sales volume.

We show the five year pattern in country code extensions as a whole below.

Dominant Country Code Extensions

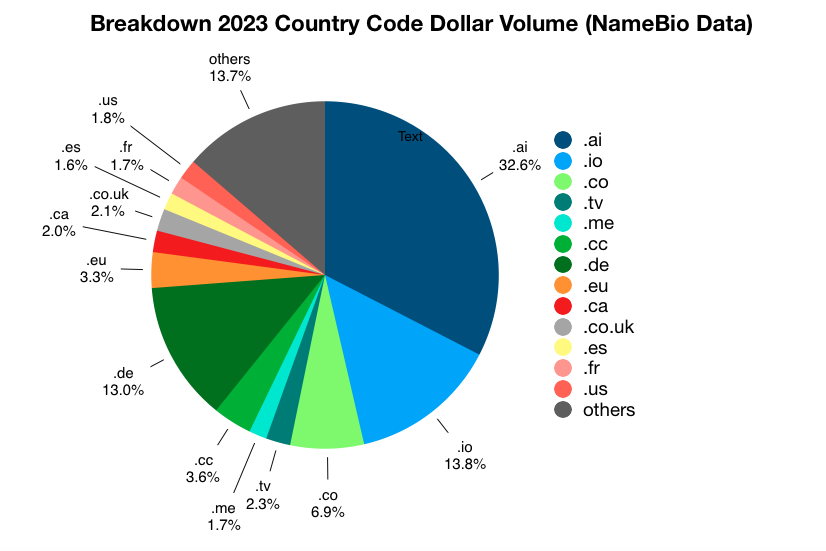

As expected, the .ai extension had a stellar 2023, accounting for almost $5.6 million in sales volume. While that is up more than 7x compared to the previous year, it is sometimes overlooked that .ai has been a strong country code for some time, with more than $1.0 million in sales volume in each of 2019, 2020 and 2021.

While .ai represented almost one-third of all country code sales volume during 2023 (32.6%), there were a number of other strong performers, as the following distribution graph indicates.

Just three country codes, .ai, .io and .co, account for more than half of all country code dollar volume.

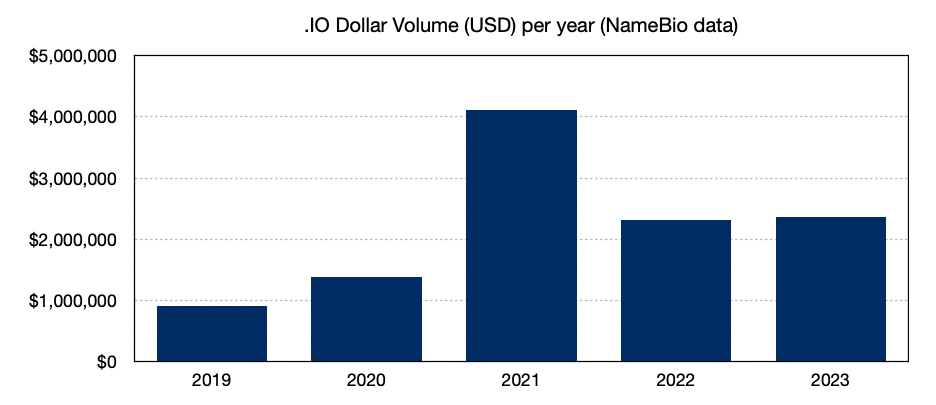

The .io dollar volume was up 1.9% in 2023 compared to 2022, but significantly less than 2021.

While .co was down 7.1% in sales volume when 2023 is compared to 2022, the drop is less than I expected. It is also less of a drop than .com experienced in 2023.

Here are results for some other country codes that I tracked:

New Domain Extensions

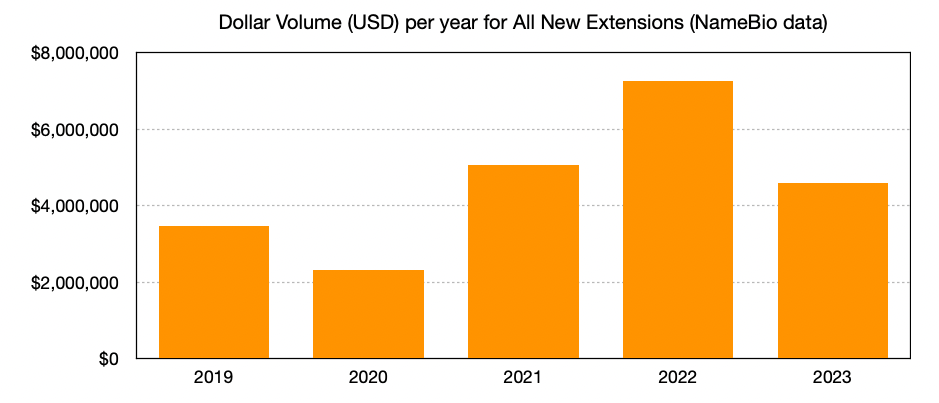

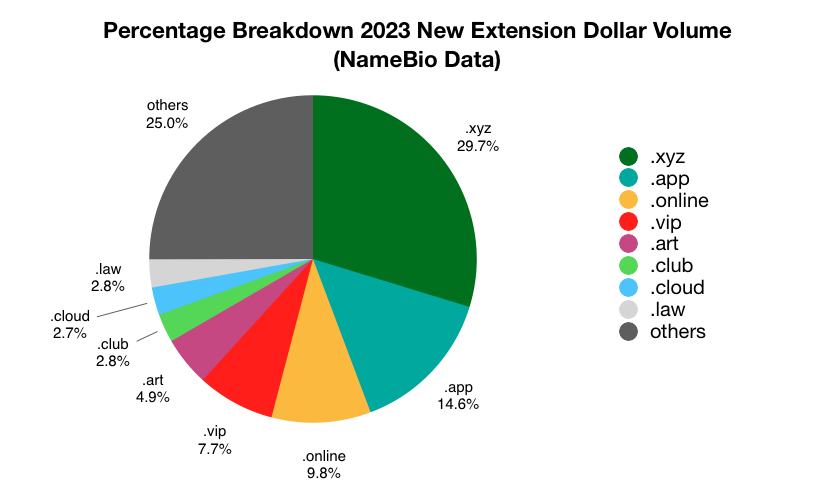

Taken as a whole, aftermarket sales volume of new domain extensions was down almost 37%, to just under $4.6 million. I show the trend over the past five years below.

While .xyz accounted for almost $1.4 million in dollar volume during 2023, that is down about 69%. The .xyz extension represents almost 30% of the new gTLD total volume.

The .app extension was up 53% in dollar volume, to $669,000, accounting for 14.6% of all new extension sales volume during 2023.

In both registrations and aftermarket sales, .online had a strong 2023, exploding from about $20,000 last year to $451,000 in dollar volume this year. Since most of the strong names are registry premium, and those sales are generally not reported, this volume is just a small part of the total .online sales record.

I had never paid much attention to .vip, and was surprised when the analysis showed that it represented 7.7% of the entire new gTLD aftermarket sales volume in 2023. It accounted for $352,000 in volume, with both the number of sales, and average value, up strongly in 2023.

Another surprise was .law, accounting for $127,000 in sales volume, up sharply. Since the extension is restricted to use by law-related professionals, agencies and organizations, holding the extension as an investment should be carefully researched.

The .tech extension volume was up sharply, to just over $61,000, compared to about $36,000 in 2022.

While .life and .live continued to have some volume, both were down sharply in 2023.

The .link extension was up slightly, but a very modest 2023 aftermarket sales volume of just over $25,000.

With strong prices, the .cloud extension dollar volume was up sharply in 2023 to $126,000 from about one-quarter that in the previous year. Given suitability for AI-powered cloud services, this might be an extension to watch.

For similar reasons, .network may have potential, and it was up 15% in dollar volume in 2023, although still less than $43,000 total for the year.

The .art extension was up in 2022 but gave some of that back in 2023, with a 35% drop in volume, to just under $225,000 in 2023.

Most of the deeply discounted extensions had trivial reported aftermarket volume. For example, a single .cfd sale at less than $1000, .icu saw only 4 sales totalling about $1000, and .top only 10 sales with a total dollar volume of about $2000.

I should point out that a larger number of new extensions, more than in previous years, had at least one or a few 4-figure aftermarket sales.

There were also significant outlier sales, such as the $79,000 789.win sale that made the top 100 sales of 2023, or the large de.fi sale, also a top sale in 2023.

Other TLDs

There was not much positive to note in other extensions. .Info still accounts for $240,000 in total volume in 2023, but that is a drop of about 15%.

There was a 60% volume drop for .biz, to just $33,000 total and fewer than 100 sales.

The .pro extension did a bit better, but still a 7.6% drop in volume to just over $66,000 total.

There are still occasional .mobi sales, but not many. Dollar volume was down 32% to a bit over $14,000 total.

If you would like to compare these results with the analysis from a year ago, go to 2022 Domain Name Sales Slightly Down.

The 2021 analysis is at the following link: 2021: Domain Name Sales Very Strong.

Last week I looked at the Top 100 Domain Sales in 2023.

The previous week I covered 37 things that happened in the domain world during 2023.

So as you look over the 2023 dollar volume analysis, what stands out for you?

Are you making changes in direction for 2024?

Is there an extension not mentioned that you are keeping an eye on? I analyzed many other TLDs than were included in the article, so if you would like numbers for a particular extension just ask in the comment section below.

My sincere thanks for NameBio. The superb interface makes it easy to do an analysis such as this one using their data. I just analyze and present the data – NameBio do the hard work.

The domain name market, at least as reflected in the NameBio data, was down 21.2% in dollar volume when 2023 is compared to 2022.

Not only was the dollar volume down when compared to the previous year, 2023 was the second lowest of the past five years, with only 2020 lower. That year had $119 million in sales.

The data was captured just after the close of the year. While some sales for the year get reported late to NameBio, by using a consistent procedure from year to year, the trends should not be biased.

Many sales, particularly retail sales, are not reported in NameBio. They may be from venues with no reported data, unreported private sales, or sales subject to NDA. Almost all registries no longer report registry premium domain name sales.

A higher percentage of wholesale transactions than retail are recorded in NameBio. While the number of sales is dominated by the wholesale transactions, the dollar volume is primarily influenced by the significant retail sales. The total dollar volume is probably the best indicator of overall strength, and is the focus of this report.

Three-Quarters Domain Pie Due To .COM Sales

If you restrict domain investing to just .com, about how much of the market are you overlooking? It turns out roughly 25%. 75% of the total dollar volume in 2023 was from a single extension, .com. The graph below shows how the entire pie is divided.

While .com dominates 2023 sales, it has slipped compared to 2022, when 81.4% of dollar volume was .com. Country code extensions and .org both increased their dollar volume share in 2023.

.COM

Dollar volume in .com was down 27.9% when 2023 sales are compared with 2022.

The graph below shows the dollar volume for .com by year. While 2023 was slightly better than 2020, a year with a sharp dip during the early months of the global pandemic, it was weaker than the other three years.

The pandemic induced shift to online transactions resulted in 2021 and 2022 being among the best years for domain investment.

.NET

The .net extension did slightly better relative to .com, but still suffered a 10.4% drop in dollar volume when 2023 is compared to 2022. It should be kept in mind that .net had dropped 25.4% in 2022 as well.

.ORG Most Consistent Growth

The .org extension is on a modest but steady increase, and that continued in 2023. When we compare 2023 with 2022, the .org sales dollar volume was up 34.4%. As we see below, there is a consistent growth pattern over the last five years.

The .org sales volume, $10.8 million in 2023, is much higher than .net, $2.9 million.

Country Code Extensions Perform Well in 2023

Country code extensions, after very strong years in 2020 and 2021 on the back of .io and .co, had suffered a pullback in 2022. But in 2023 country code extensions as a whole saw a 23.5% increase in dollar volume compared to 2022. During 2023 country codes accounted for just over $17.1 million in NameBio-reported sales volume.

We show the five year pattern in country code extensions as a whole below.

Dominant Country Code Extensions

As expected, the .ai extension had a stellar 2023, accounting for almost $5.6 million in sales volume. While that is up more than 7x compared to the previous year, it is sometimes overlooked that .ai has been a strong country code for some time, with more than $1.0 million in sales volume in each of 2019, 2020 and 2021.

While .ai represented almost one-third of all country code sales volume during 2023 (32.6%), there were a number of other strong performers, as the following distribution graph indicates.

Just three country codes, .ai, .io and .co, account for more than half of all country code dollar volume.

The .io dollar volume was up 1.9% in 2023 compared to 2022, but significantly less than 2021.

While .co was down 7.1% in sales volume when 2023 is compared to 2022, the drop is less than I expected. It is also less of a drop than .com experienced in 2023.

Here are results for some other country codes that I tracked:

- .de was down 7.0%, but the almost $2.4 million accounted for 13% of all country code volume.

- .tv dropped 23.5% in dollar volume, although still $389,000.

- .me was relatively constant, just 2.3% decrease in dollar volume.

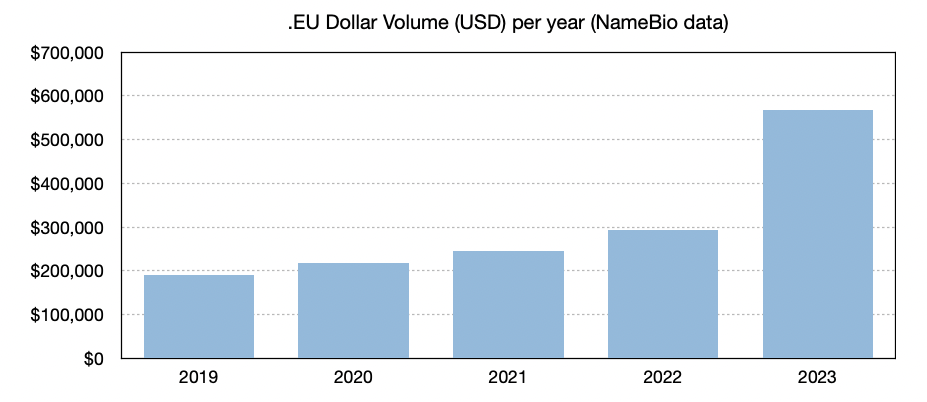

- .eu has been edging upward over recent years, but took a major step up in 2023, almost doubling dollar volume to just over $568,000.

- .cc was up strongly, from $352,000 in 2022 to just over $621,000 in 2023. Keep in mind that almost all of the high-value sales in this extension are numeric names, however.

- .co.uk This national extension accounted for more than $355,000 in 2023, but that was down 30% compared to 2022. The .uk was down less, just 5.3%, but much less volume.

- .us After strong growth in 2022, the .us extension gave back much of that, with a 15.4% drop in volume in 2023. The 2023 dollar volume in .us was just under $315,000.

- .vc Venture capital has had a difficult year, so it is not surprising to see almost 18% decline in sales volume for .vc. The 2023 volume was $197,000.

- .to The repurposed .to extension dropped 82%, probably related to the disruption in major reseller after the death of the CEO. It should be pointed out that 2022 had been a particularly strong year for the extension.

- France’s .fr is a strong national extension, with $289,000, but that was down 28.1%.

- The picture was not much different for Switzerland’s .ch, down 22% in 2023, but a volume of almost $227,000.

- Spain’s .es had a strong 2023, up 68% in sales volume.

- Neither have a high number of reported sales, but strong average prices helped propel Australia’s .com.au and Canada’s .ca to positive years, with .com.au up almost 4x, to $118,000, and the .ca up 79% to $343,000.

- .gg popular with the gaming community dropped by more than half in sales volume, from already somewhat weak numbers.

- India’s .in accounted for $137,000 volume in 2023, but that was down more than 60% compared to 2022. One might have expected more from a strongly growing economy.

New Domain Extensions

Taken as a whole, aftermarket sales volume of new domain extensions was down almost 37%, to just under $4.6 million. I show the trend over the past five years below.

While .xyz accounted for almost $1.4 million in dollar volume during 2023, that is down about 69%. The .xyz extension represents almost 30% of the new gTLD total volume.

The .app extension was up 53% in dollar volume, to $669,000, accounting for 14.6% of all new extension sales volume during 2023.

In both registrations and aftermarket sales, .online had a strong 2023, exploding from about $20,000 last year to $451,000 in dollar volume this year. Since most of the strong names are registry premium, and those sales are generally not reported, this volume is just a small part of the total .online sales record.

I had never paid much attention to .vip, and was surprised when the analysis showed that it represented 7.7% of the entire new gTLD aftermarket sales volume in 2023. It accounted for $352,000 in volume, with both the number of sales, and average value, up strongly in 2023.

Another surprise was .law, accounting for $127,000 in sales volume, up sharply. Since the extension is restricted to use by law-related professionals, agencies and organizations, holding the extension as an investment should be carefully researched.

The .tech extension volume was up sharply, to just over $61,000, compared to about $36,000 in 2022.

While .life and .live continued to have some volume, both were down sharply in 2023.

The .link extension was up slightly, but a very modest 2023 aftermarket sales volume of just over $25,000.

With strong prices, the .cloud extension dollar volume was up sharply in 2023 to $126,000 from about one-quarter that in the previous year. Given suitability for AI-powered cloud services, this might be an extension to watch.

For similar reasons, .network may have potential, and it was up 15% in dollar volume in 2023, although still less than $43,000 total for the year.

The .art extension was up in 2022 but gave some of that back in 2023, with a 35% drop in volume, to just under $225,000 in 2023.

Most of the deeply discounted extensions had trivial reported aftermarket volume. For example, a single .cfd sale at less than $1000, .icu saw only 4 sales totalling about $1000, and .top only 10 sales with a total dollar volume of about $2000.

I should point out that a larger number of new extensions, more than in previous years, had at least one or a few 4-figure aftermarket sales.

There were also significant outlier sales, such as the $79,000 789.win sale that made the top 100 sales of 2023, or the large de.fi sale, also a top sale in 2023.

Other TLDs

There was not much positive to note in other extensions. .Info still accounts for $240,000 in total volume in 2023, but that is a drop of about 15%.

There was a 60% volume drop for .biz, to just $33,000 total and fewer than 100 sales.

The .pro extension did a bit better, but still a 7.6% drop in volume to just over $66,000 total.

There are still occasional .mobi sales, but not many. Dollar volume was down 32% to a bit over $14,000 total.

If you would like to compare these results with the analysis from a year ago, go to 2022 Domain Name Sales Slightly Down.

The 2021 analysis is at the following link: 2021: Domain Name Sales Very Strong.

Last week I looked at the Top 100 Domain Sales in 2023.

The previous week I covered 37 things that happened in the domain world during 2023.

So as you look over the 2023 dollar volume analysis, what stands out for you?

Are you making changes in direction for 2024?

Is there an extension not mentioned that you are keeping an eye on? I analyzed many other TLDs than were included in the article, so if you would like numbers for a particular extension just ask in the comment section below.

My sincere thanks for NameBio. The superb interface makes it easy to do an analysis such as this one using their data. I just analyze and present the data – NameBio do the hard work.

Last edited: