While most modern businesses need a domain name, that does not mean that all sectors and niches offer an equal naming opportunity.

What are some of the factors that make names more likely to sell for good returns in a niche or sector?

In this article, I consider 8 relevant factors for sectors that offer strong naming potential. With a bit of twisting, I put them into a framework that creates the acronym DISPLACE:

Disruptive is a term that is tossed around a lot. Technologies can be disruptive – imagine all of the fields that were disrupted when personal computers were introduced. Graphic design could be done in new ways, writing, editing and publishing became infinitely more efficient, spreadsheets expanded analysis and record keeping, and so on.

The internet itself was an even more disruptive technology that impacted virtually every business and organization in the world.

But ideas or approaches can also be disruptive. The article by Alexandra Twin on Disruptive Innovation uses the example of Amazon as a disruptive innovation.

Another example of a disruptive innovation would be the collaborative economy, in which consumers serve each other. This idea has transformed rides, food delivery, and much more.

Whether we are talking disruptive technologies or disruptive innovations, the main market for domain names may not be directly in the innovative technology, but rather in the ways that technology can be applied.

Artificial intelligence is the perfect example of a disruptive technology. AI can be applied in an almost unlimited number of niches, and the domain demand is, primarily, within those applications, rather than the central concepts of machine learning, neural networks, large language models, etc.

When you hear about something new, ask yourself how widely that idea or technology can disrupt how we have traditionally done things. Strong demand for names is more likely when the potential disruption is widespread.

Innovative

There are disruptions of one sort or another happening in business every day. But the most important ones involve something truly innovative. Incremental improvements can keep businesses profitable, but the major startup naming opportunities come from significant innovations.

Innovative is one of those words that is widely used, probably over-used, yet surprisingly hard to clearly define. I like this simple definition by Carla Johnson in How To Identify An Innovative Idea:

Scaleable

The term scaleable can mean many things, but in this context I mean is it possible to apply the innovative idea starting on a rather small scale and then expanding to a global market.

Let’s take an example from applied artificial intelligence. The ability of large language models (LLM) to interpret language and to respond in ways that are similar to human intelligence suggests applications in AI-enabled counselling. One might imagine starting this in one country, and one area of counselling, in a single language, perhaps on a rather small scale. This makes sense, since you need oversight by licensed professionals, and quality assurance controls. But ultimately the idea is widely scaleable to a global market, far more scaleable than a traditional counselling firm.

Any of the “as a Service” ideas are by nature scaleable. Ryan LaFlamme put together a nice list of 51 types of aaS businesses.

Scaleable ideas are best for startups, and therefore for domain demand. So ideally emphasize domain names related to ideas that are innovative, disruptive and scaleable. But we are forgetting at least one important consideration.

Profitable

Some innovative ideas are tied to businesses with limited profitability. There may well be a few startups eke out success in the niche, but not many.

As a domain investor, you probably need to be selling names for at least 4-figures to not be losing money overall. There may be tiny niches or very local businesses that need a domain name, but they will not be willing to pay $3000 or more for a domain name. Ideally, concentrate on names for businesses with strong profitability potential.

It is hard to be precise, but think about what a successful startup might reasonably make over the first three years of operation, and apply some percentage to see the maximum amount they are likely to be willing to pay for a domain name.

While not directly related to profitability, the need of startups in a niche to attract significant early-stage funding will make them more open to paying a reasonable amount for a domain name.

Startups that serve consumers, as opposed to other businesses, generally have a stronger need for a high-quality name. But startups also depend on the respect of their name in seeking funding, so B2B also can have a strong motivation to secure a high-quality name early.

Low Barrier

OpenAI did something pretty brilliant when they released ChatGPT to the world. People everywhere could begin to use it, see that it worked, and begin to dream how they could disrupt a business with the technology.

Using AI in some applied area may be the ultimate low barrier business. For simply the low, and dropping, cost of AI services, a startup can employ artificial intelligence without all of the development and management costs, and development window, involved.

It can be relatively low cost to get a cloud-based AI enabled business up and running. This means that many startups will be seeking domain names.

The sectors with the most potential for domain investors will be those where the barrier to setting up a business is low, there is potential for significant profit, and there is an obvious case for the advantage offered by disrupting traditional approaches.

Accessible

This could be considered just another aspect of low barrier, but the technologies and ideas that will most impact the naming market will be those that are accessible in terms of simplicity to start.

Some innovative and important ideas require long timeframes, big teams, multiple levels of approval, and huge development budgets. Think developing a new pharmaceutical line or medical procedure. While it is important that some individuals and companies invest the effort in these, and some will ultimately be very successful, they are not accessible enough that there will suddenly be a multitude of startups each requiring domain names.

Creative

Creative ideas spark the startup economy. As we saw above, innovation involves more than creativity, but creativity is one critical component.

But what exactly is creativity? I went searching online for some definitions, most of which did not resonate much with me. One of the ones that I liked was by Anastasia Shch from the article The Importance of Creativity in Business:

It is not simply enough that a new technology or approach could be applied to advantage, but the startups with most potential will have some creative approach or insight, or laser focus on an original concept or idea that sets them apart from others.

Everywhere

If looking for sectors with high potential demand for domain names, think of businesses that you could see many places, or at least that will impact many people globally. These might be businesses that are found multiple times in each city, or online businesses with a global clientele.

So that completes DISPLACE: Disruptive, Innovative, Scaleable, Profitable, Low Barrier, Accessible, Creative and Everywhere.

Why AI Checks Most of the Boxes

We have probably seen few innovations that match the components of the DISPLACE framework as well as artificial intelligence.

While the development of AI itself was not accessible, or everywhere, once it reached the stage to be useful, it became a disruptive technology that could be applied in myriad niches to do things better, easier and cheaper, and to do things that had never been feasible before. Those applications were indeed innovative, scaleable, low barrier, accessible and potentially very profitable.

AI Domains Continue Momentum

I did a quick check on NameBio, and over the past two years there are $8.9 million in .ai extension sales recorded, over more than 4200 names.

There has also been significant sales volume in term+AI and AI+term in .com, but at a lower dollar volume.

So far in the early months of 2024, at least listed at NameBio, there have been well over 900 .ai extension sales, with more than $2.6 million in volume.

Of the top 20 sales recorded at NameBio so far in 2024, 6 have been .ai. In case wondering about the others, 9 are .com, 2 .io, 1 .net and 2 in new domain extensions.

Case Study: Devin

Let’s look at one example as a case study. This week, on March 12, 2024, Cognition-Labs, introduced Devin, an AI software engineer. This article provides an overview of the various ways Devin can be used, everything from troubleshooting code to learning from documentation. Apparently Devin was successful when they tried it on code-related Upwork jobs.

They also employed Devin to solve real issues on GitHub from various open source projects. On the benchmark for that, Devin scored about 14%. That might not at first glance seem impressive, but GPT 3.5 scored only about 0.5% on the benchmark, and GPT 4.0 about 1.7%. Devin did better by about a factor of 3 compared to the most successful previous approach.

Think of all of the different ways that software engineers contribute to research, development and trouble shooting, and how scaleable a high-performance, and self-learning, AI software engineer could be. Cognition-Labs recently secured over $21 million in early-stage funding, despite being a recent and quite small company.

In case you missed the news, Cognition-Labs also secured a couple of great domain names this week. They acquired Cognition.ai for $110,000, which is now redirecting to Cognition-Labs.com. They also obtained Devin.ai. for a price of $30,000.

Think of Devin.ai and how well it matches almost every point in the DISPLACE framework.

Devin also demonstrates that, in this field, single-word .ai names remain the hottest trend, although the types of words can vary. Cognition is an obvious word for the AI-field, with broad interpretation possible, and that is how they renamed their brand. However, the specific first product uses a name that feels more personal and approachable. I suspect Devin had the added advantage that the Dev start is suggestive of developer.

WIPO Global Innovation Tracker

The WIPO Global Innovation Tracker is a gold mine of information on key innovation sectors, research and development spending, venture capital and more.

This can give investors ideas for niches and sectors with strong disruption capability, as well as a feeling for the recent climate. For example, venture capital had a stellar 2021, while in 2022 the number of startups funded, but not the investment volume, remained strong.

US Census Bureau Business Start Statistics

While the data only directly applies to the United States, the US Census Bureau has an easy-to-use, and free, tracker of business starts in various sectors. Since the data is updated monthly, it is an easy way to see which sectors are growing. I covered use of the tool by domain investors in the article What Are Business Startup Rates?

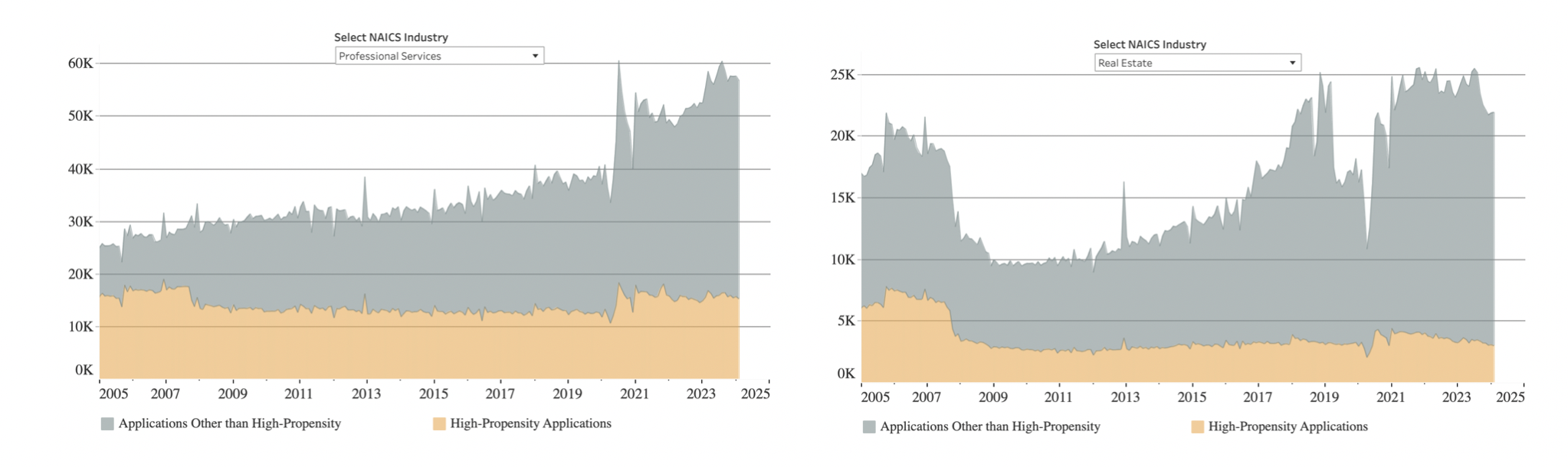

Below is an example that shows how the startup pattern can vary across fields. On the left below, is the business formation rate in the professional services sector. We see that there was a slight dip at the start of the pandemic, but then a huge increase over the traditional level, and that has largely continued since.

On the right, we see a rather different pattern for the real estate sector. That was already in decline prior to the pandemic. While the last few years saw a recovery, it has been relatively flat recently. We also see a huge drop at the time of the 2008 financial downturn.

It should be noted that in both cases, however, there has been relatively little change in businesses likely to have a payroll, the high-propensity applications, shown in orange. So most of the growth and variability is in very small businesses. This can be good for domain investors, but the likely pricing budget for a name to be used by a very small startup also needs to be kept in mind.

You can do your own investigations using the US Census startup numbers at the following link.

Key Points

Here is a summary of key messages I take from this for domain name investors.

Updates:

March 14, 2024 Price added for domain name Devin.ai. Thanks to @MariaEl and @silentg.

March 15, 2024 Wording error corrected and in one place company name Cognition-Labs was corrected.

What are some of the factors that make names more likely to sell for good returns in a niche or sector?

In this article, I consider 8 relevant factors for sectors that offer strong naming potential. With a bit of twisting, I put them into a framework that creates the acronym DISPLACE:

- Disruptive

- Innovative

- Scaleable

- Profitable

- Low Entry Barrier

- Accessible

- Creative

- Everywhere

Disruptive is a term that is tossed around a lot. Technologies can be disruptive – imagine all of the fields that were disrupted when personal computers were introduced. Graphic design could be done in new ways, writing, editing and publishing became infinitely more efficient, spreadsheets expanded analysis and record keeping, and so on.

The internet itself was an even more disruptive technology that impacted virtually every business and organization in the world.

But ideas or approaches can also be disruptive. The article by Alexandra Twin on Disruptive Innovation uses the example of Amazon as a disruptive innovation.

Another example of a disruptive innovation would be the collaborative economy, in which consumers serve each other. This idea has transformed rides, food delivery, and much more.

Whether we are talking disruptive technologies or disruptive innovations, the main market for domain names may not be directly in the innovative technology, but rather in the ways that technology can be applied.

Artificial intelligence is the perfect example of a disruptive technology. AI can be applied in an almost unlimited number of niches, and the domain demand is, primarily, within those applications, rather than the central concepts of machine learning, neural networks, large language models, etc.

When you hear about something new, ask yourself how widely that idea or technology can disrupt how we have traditionally done things. Strong demand for names is more likely when the potential disruption is widespread.

Innovative

There are disruptions of one sort or another happening in business every day. But the most important ones involve something truly innovative. Incremental improvements can keep businesses profitable, but the major startup naming opportunities come from significant innovations.

Innovative is one of those words that is widely used, probably over-used, yet surprisingly hard to clearly define. I like this simple definition by Carla Johnson in How To Identify An Innovative Idea:

Innovation is related to creativity, see below, but it is not the same as creativity. Not all creative ideas will also be great, or able to be reliably utilized.Innovation is about consistently coming up with new, great, and reliable ideas.

Scaleable

The term scaleable can mean many things, but in this context I mean is it possible to apply the innovative idea starting on a rather small scale and then expanding to a global market.

Let’s take an example from applied artificial intelligence. The ability of large language models (LLM) to interpret language and to respond in ways that are similar to human intelligence suggests applications in AI-enabled counselling. One might imagine starting this in one country, and one area of counselling, in a single language, perhaps on a rather small scale. This makes sense, since you need oversight by licensed professionals, and quality assurance controls. But ultimately the idea is widely scaleable to a global market, far more scaleable than a traditional counselling firm.

Any of the “as a Service” ideas are by nature scaleable. Ryan LaFlamme put together a nice list of 51 types of aaS businesses.

Scaleable ideas are best for startups, and therefore for domain demand. So ideally emphasize domain names related to ideas that are innovative, disruptive and scaleable. But we are forgetting at least one important consideration.

Profitable

Some innovative ideas are tied to businesses with limited profitability. There may well be a few startups eke out success in the niche, but not many.

As a domain investor, you probably need to be selling names for at least 4-figures to not be losing money overall. There may be tiny niches or very local businesses that need a domain name, but they will not be willing to pay $3000 or more for a domain name. Ideally, concentrate on names for businesses with strong profitability potential.

It is hard to be precise, but think about what a successful startup might reasonably make over the first three years of operation, and apply some percentage to see the maximum amount they are likely to be willing to pay for a domain name.

While not directly related to profitability, the need of startups in a niche to attract significant early-stage funding will make them more open to paying a reasonable amount for a domain name.

Startups that serve consumers, as opposed to other businesses, generally have a stronger need for a high-quality name. But startups also depend on the respect of their name in seeking funding, so B2B also can have a strong motivation to secure a high-quality name early.

Low Barrier

OpenAI did something pretty brilliant when they released ChatGPT to the world. People everywhere could begin to use it, see that it worked, and begin to dream how they could disrupt a business with the technology.

Using AI in some applied area may be the ultimate low barrier business. For simply the low, and dropping, cost of AI services, a startup can employ artificial intelligence without all of the development and management costs, and development window, involved.

It can be relatively low cost to get a cloud-based AI enabled business up and running. This means that many startups will be seeking domain names.

The sectors with the most potential for domain investors will be those where the barrier to setting up a business is low, there is potential for significant profit, and there is an obvious case for the advantage offered by disrupting traditional approaches.

Accessible

This could be considered just another aspect of low barrier, but the technologies and ideas that will most impact the naming market will be those that are accessible in terms of simplicity to start.

Some innovative and important ideas require long timeframes, big teams, multiple levels of approval, and huge development budgets. Think developing a new pharmaceutical line or medical procedure. While it is important that some individuals and companies invest the effort in these, and some will ultimately be very successful, they are not accessible enough that there will suddenly be a multitude of startups each requiring domain names.

Creative

Creative ideas spark the startup economy. As we saw above, innovation involves more than creativity, but creativity is one critical component.

But what exactly is creativity? I went searching online for some definitions, most of which did not resonate much with me. One of the ones that I liked was by Anastasia Shch from the article The Importance of Creativity in Business:

Creativity in business is a way of thinking that inspires, challenges, and helps people to find innovative solutions and create opportunities out of problems.

It is not simply enough that a new technology or approach could be applied to advantage, but the startups with most potential will have some creative approach or insight, or laser focus on an original concept or idea that sets them apart from others.

Everywhere

If looking for sectors with high potential demand for domain names, think of businesses that you could see many places, or at least that will impact many people globally. These might be businesses that are found multiple times in each city, or online businesses with a global clientele.

So that completes DISPLACE: Disruptive, Innovative, Scaleable, Profitable, Low Barrier, Accessible, Creative and Everywhere.

Why AI Checks Most of the Boxes

We have probably seen few innovations that match the components of the DISPLACE framework as well as artificial intelligence.

While the development of AI itself was not accessible, or everywhere, once it reached the stage to be useful, it became a disruptive technology that could be applied in myriad niches to do things better, easier and cheaper, and to do things that had never been feasible before. Those applications were indeed innovative, scaleable, low barrier, accessible and potentially very profitable.

AI Domains Continue Momentum

I did a quick check on NameBio, and over the past two years there are $8.9 million in .ai extension sales recorded, over more than 4200 names.

There has also been significant sales volume in term+AI and AI+term in .com, but at a lower dollar volume.

So far in the early months of 2024, at least listed at NameBio, there have been well over 900 .ai extension sales, with more than $2.6 million in volume.

Of the top 20 sales recorded at NameBio so far in 2024, 6 have been .ai. In case wondering about the others, 9 are .com, 2 .io, 1 .net and 2 in new domain extensions.

Case Study: Devin

Let’s look at one example as a case study. This week, on March 12, 2024, Cognition-Labs, introduced Devin, an AI software engineer. This article provides an overview of the various ways Devin can be used, everything from troubleshooting code to learning from documentation. Apparently Devin was successful when they tried it on code-related Upwork jobs.

They also employed Devin to solve real issues on GitHub from various open source projects. On the benchmark for that, Devin scored about 14%. That might not at first glance seem impressive, but GPT 3.5 scored only about 0.5% on the benchmark, and GPT 4.0 about 1.7%. Devin did better by about a factor of 3 compared to the most successful previous approach.

Think of all of the different ways that software engineers contribute to research, development and trouble shooting, and how scaleable a high-performance, and self-learning, AI software engineer could be. Cognition-Labs recently secured over $21 million in early-stage funding, despite being a recent and quite small company.

In case you missed the news, Cognition-Labs also secured a couple of great domain names this week. They acquired Cognition.ai for $110,000, which is now redirecting to Cognition-Labs.com. They also obtained Devin.ai. for a price of $30,000.

Think of Devin.ai and how well it matches almost every point in the DISPLACE framework.

Devin also demonstrates that, in this field, single-word .ai names remain the hottest trend, although the types of words can vary. Cognition is an obvious word for the AI-field, with broad interpretation possible, and that is how they renamed their brand. However, the specific first product uses a name that feels more personal and approachable. I suspect Devin had the added advantage that the Dev start is suggestive of developer.

WIPO Global Innovation Tracker

The WIPO Global Innovation Tracker is a gold mine of information on key innovation sectors, research and development spending, venture capital and more.

This can give investors ideas for niches and sectors with strong disruption capability, as well as a feeling for the recent climate. For example, venture capital had a stellar 2021, while in 2022 the number of startups funded, but not the investment volume, remained strong.

US Census Bureau Business Start Statistics

While the data only directly applies to the United States, the US Census Bureau has an easy-to-use, and free, tracker of business starts in various sectors. Since the data is updated monthly, it is an easy way to see which sectors are growing. I covered use of the tool by domain investors in the article What Are Business Startup Rates?

Below is an example that shows how the startup pattern can vary across fields. On the left below, is the business formation rate in the professional services sector. We see that there was a slight dip at the start of the pandemic, but then a huge increase over the traditional level, and that has largely continued since.

Two screen captures from US Census data on business start numbers. On the left is the professional services sector, while the real estate sector is plotted on the right.

On the right, we see a rather different pattern for the real estate sector. That was already in decline prior to the pandemic. While the last few years saw a recovery, it has been relatively flat recently. We also see a huge drop at the time of the 2008 financial downturn.

It should be noted that in both cases, however, there has been relatively little change in businesses likely to have a payroll, the high-propensity applications, shown in orange. So most of the growth and variability is in very small businesses. This can be good for domain investors, but the likely pricing budget for a name to be used by a very small startup also needs to be kept in mind.

You can do your own investigations using the US Census startup numbers at the following link.

Key Points

Here is a summary of key messages I take from this for domain name investors.

- Some innovations will have greater potential than other sectors for creating a strong demand for startup names. The DISPLACE framework is one way to keep these factors in mind.

- Ask yourself how readily an innovation can scale up, and how low are the barriers to getting started.

- The potential profitability of the sector will determine a likely upper-end cutoff on domain name pricing. When pricing a name think in terms of what would be the income generated by a business that might use this name, and apply some reasonable percentage of that in setting the maximum price. Of course other factors, like pricing of competitive names, also needs to be taken into account.

- Applied AI is probably the perfect sector for matching all of the DISPLACE components. More often, however, niches match some of the DISPLACE aspects really well, but others not so much.

- When investing in names intended for startups, think like a startup founderr. Laser focus on names suited for realistic disruptive businesses with significant financial potential.

- Look at startup incubators and venture capital reports to learn the sectors and niches that are getting funded.

- Study the types of names that early adopters in these niches are choosing. It is likely that they will influence the next stage of startups.

- Keep in mind the general aspects of a strong name such as length, clarity, positive, etc. still apply.

- Remember that most companies will choose a distinctive name, rather than a totally generic and descriptive term, as their brand.

- Keep up-to-date the most recent data and examples. Startup trends can change quickly.

Updates:

March 14, 2024 Price added for domain name Devin.ai. Thanks to @MariaEl and @silentg.

March 15, 2024 Wording error corrected and in one place company name Cognition-Labs was corrected.

Last edited: