The first six months of 2023 resulted in just over 70,000 NameBio-listed domain sales in total, with a dollar volume of just over $66 million.

That is a decrease of 21.5% in sales dollar volume compared to the same six months of 2022.

In this article I use the same procedure I have since 2019, including all sales in the Namebio main database for the first six months of each year. NameBio-listed sales are a combination of wholesale acquisitions and retail sales. Average prices are therefore not very meaningful, so this year I am only reporting sales dollar volume, a metric that tends to be dominated by the retail sales.

COM Continues Domination, But Down

The dollar volume in

The

The graph below shows the dollar volume in

NET Also Down

The dollar volume in

With the recently announced ICANN agreement to extend the Verisign

ORG

In a relative sense,

The dollar volume of

As the graph below shows, while there was a small dip in 2023,

Country Code Domains Slightly Down Overall

Country code domain names had a spectacular 2021, but a much weaker 2022. The dollar volume dropped another 6.3% in the first half of 2023. That decrease was less than domains overall, or for

Lumping all country codes together is deceptive, since the various national and generalized country codes each have their own pattern. I provide data for some of the more interesting country codes below.

IO Dollar Volume Down 30%

Sales in

The multi-year graph below shows that

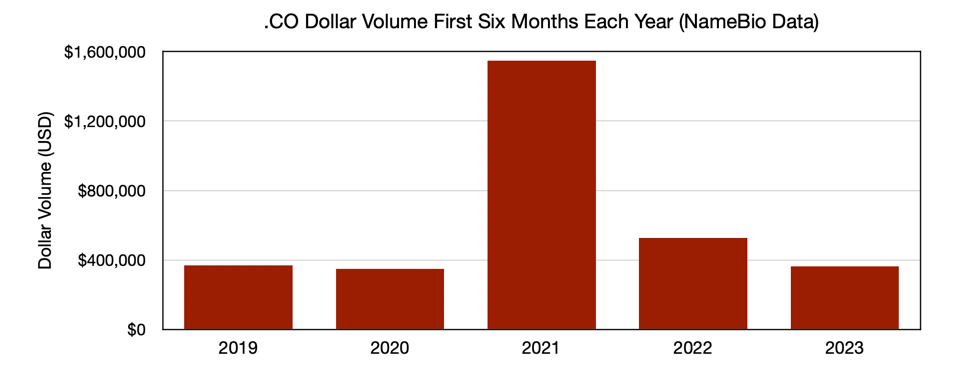

CO Decline

The pattern in

Other Country Code Extensions

I tracked many other country code extensions, and here are comments for some of them. Note that in many cases the number of sales is relatively small, so apparent trends may not be statistically significant.

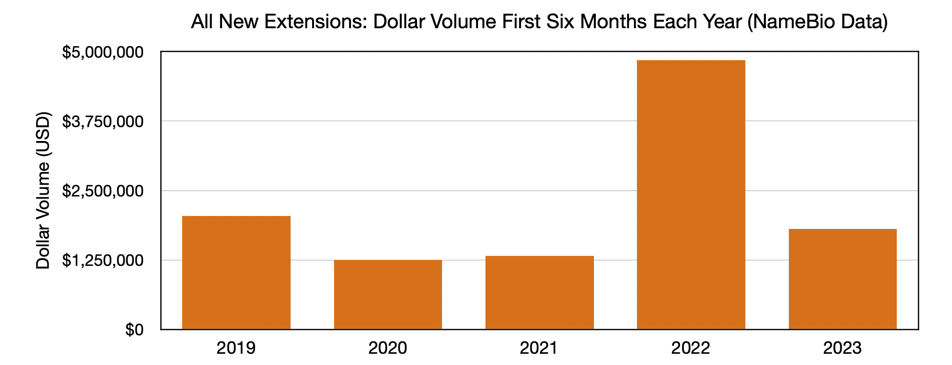

New Extensions Down

Taken as a whole, new extension sales pulled back strongly compared to 2022, although 2023 was better than 2020 or 2021. The dollar volume in the first six months of 2023 was $1.81 million, compared to $4.85 million during the same period in 2022. The trend over the five years is shown below.

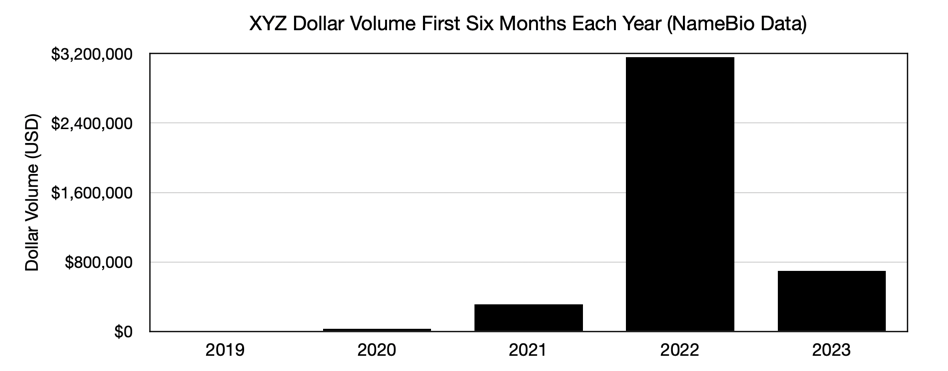

XYZ Drops

After huge increases during the last few years, sales volume in

While

Other New Extensions

Here are comments on some other new gTLDs that I tracked.

The .biz and .info extensions have both been around for many years.

Keep in mind that this is a comparison of sales from the first six months of each year only. Economic and world events can have serious impacts in a short period of time. I do a similar analysis published in the NamePros Blog at the end of each year, comparing full year results.

Remember that by no means all domain name sales are reported in NameBio. It is hard to know if there are significant differences between extensions in the fraction of sales that are reported in NameBio.

NameBio reports a higher percentage of wholesale transactions than retail. As wholesale prices have risen, it is likely that a higher percentage of wholesale transactions appear in recent years.

The ratio of number of NameBio-reported wholesale to retail sales varies with extension. While the number of TLDs covered by the standard expired auctions has increased recently, still the expired auctions are dominated by the major legacy extensions, especially

Over the years, what gets reported in NameBio has changed. That impacts the data, although in the period covered I do not know of significant drops in coverage, so it is likely that the decline in sales volume is indeed real.

As for previous reports in this series, I collected the data right at the end of the six month period. That means sales reported later, but that occurred during the six month period, will not have been included. Therefore, you may find slightly different data if you later check NameBio. Since I was consistent in 2019, 2200, 2221, 2022 and 2223, however, there should not be a systematic bias.

Past Years

This is the fifth analysis of the first six months of the year. Here are links to the previous articles:

The decline in sales volume is concerning. While part might be due to declines in wholesale acquisitions, it seems that retail sales overall are in decline. It is possible that venues that typically don’t get reported in NameBio may be taking more of the market.

Please share in the comments below what you conclude from the data. Also, feel free to include mention of additional TLDs that you would like included in future editions of the analysis.

Addition:

I can't do a poll here, but to help assess what percentage of individual retail sales are getting reported to NameBio, could you please complete the poll here.

Huge thanks to Namebio, an incredible resource for domain name sales data.

That is a decrease of 21.5% in sales dollar volume compared to the same six months of 2022.

In this article I use the same procedure I have since 2019, including all sales in the Namebio main database for the first six months of each year. NameBio-listed sales are a combination of wholesale acquisitions and retail sales. Average prices are therefore not very meaningful, so this year I am only reporting sales dollar volume, a metric that tends to be dominated by the retail sales.

COM Continues Domination, But Down

The dollar volume in

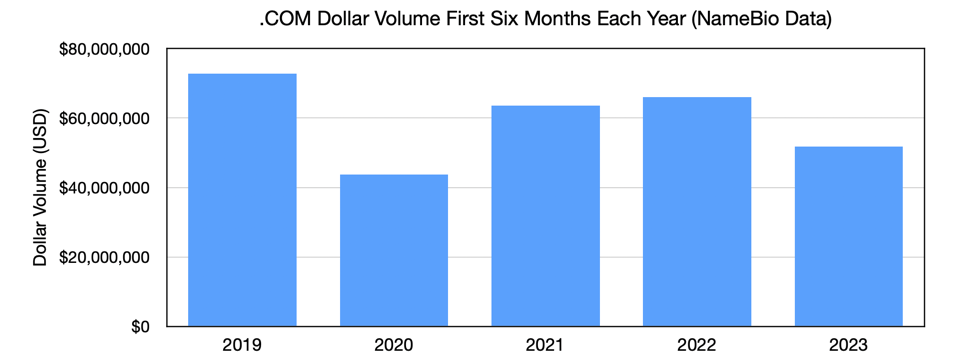

.com alone was down significantly, from $66.1 million in 2022 to $51.8 million in 2022. That is a decrease of 21.6%.The

.com extension continues to represent most of the aftermarket. In the first six months of 2023 .com accounted for 78.5% of all sales by dollar volume, unchanged from the same months in 2022.The graph below shows the dollar volume in

.com sales, at least those reported in NameBio, over the first six months of each of the last five years.NET Also Down

The dollar volume in

.net also dipped for the first six months of 2023, although the decrease was less than .com, at 8.5%.With the recently announced ICANN agreement to extend the Verisign

.net contract without going to tender, and allowing up to 10% wholesale price increase per year, .net domain investments will become more challenging.ORG

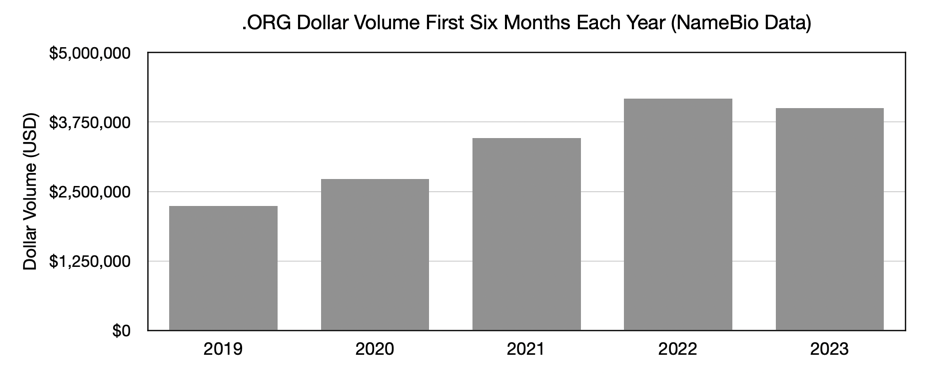

In a relative sense,

.org was the strongest of the major legacy extensions, although it was down 4.1% in dollar volume when we compare the first six months of 2023 with 2022.The dollar volume of

.org during the first six months of 2023 was $4.0 million, compared to just under $1.5 million for .net during the same period.As the graph below shows, while there was a small dip in 2023,

.org has been generally moving upward over the five years.Country Code Domains Slightly Down Overall

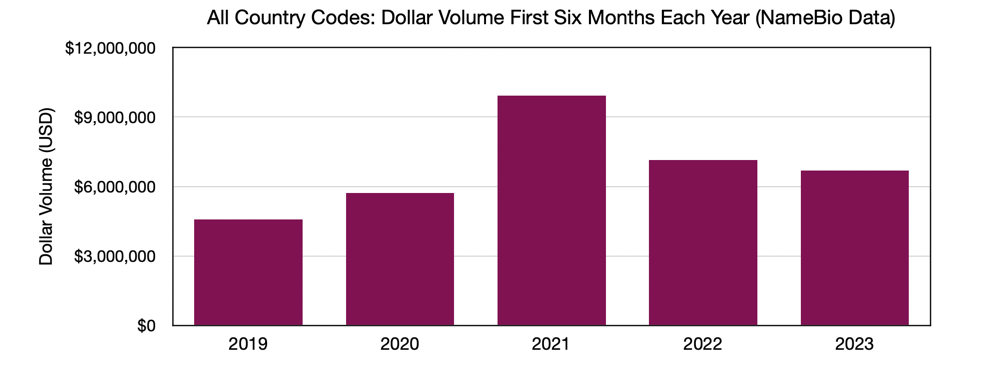

Country code domain names had a spectacular 2021, but a much weaker 2022. The dollar volume dropped another 6.3% in the first half of 2023. That decrease was less than domains overall, or for

.com alone. January to June sales volume, as reported in NameBio, is shown below for a five year period.Lumping all country codes together is deceptive, since the various national and generalized country codes each have their own pattern. I provide data for some of the more interesting country codes below.

IO Dollar Volume Down 30%

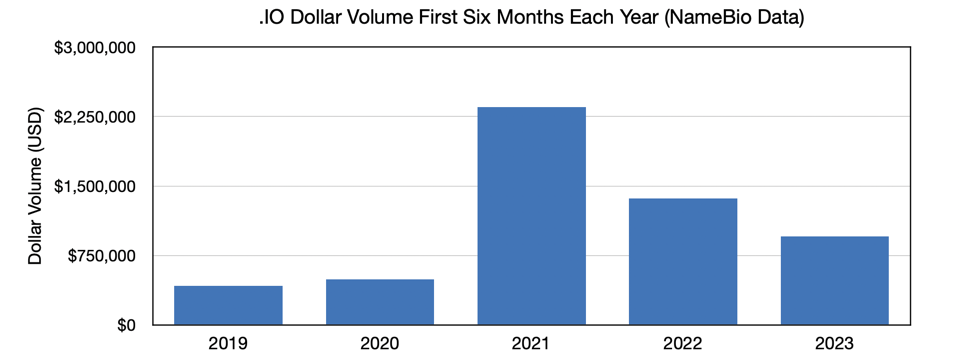

Sales in

.io contributed almost $955,000 during the first six months of 2023, but that was down 30% compared to the same period in 2022.The multi-year graph below shows that

.io sales volume rose dramatically in the first six months of 2021, but has been in decline since then. However, the 2023 volume is still more than double what it had been in the first half of 2019 or 2020.CO Decline

The pattern in

.co is pretty similar. The first six months of 2023 saw just over $362,000 in aftermarket sales reported in NameBio for the extension. That is down just over 31% compared to the same months in 2022. I plot below the five year trend.Other Country Code Extensions

I tracked many other country code extensions, and here are comments for some of them. Note that in many cases the number of sales is relatively small, so apparent trends may not be statistically significant.

- .AI: With all of the progress and attention on artificial intelligence, we would expect

.aito have a strong start to 2023. That indeed was the case, with $1.15 million in reported sales volume during the first half of 2023, compared to just under $348,000 during the same months of 2022. - .CC: In last year’s analysis the

.ccextension had approximately doubled sales dollar volume. Driven by eye-catching numerical sales, the first half of 2023 have continued strong in the extension, with.ccdollar volume up from $179,000 during the first half of 2022 to almost $432,000 in 2023. - .CN: While there are other indicators that the Asian domain market is picking up, the NameBio-reported sales volume for China’s

.cnwas down 69% when we compare the first half of 2023 to 2022. The numbers are based on a small number of sales, however. - .CO.UK: The UK’s

.co.ukwas down about 25% in sales volume. Based on just a handful of sales, the.ukwas up in sales volume, however. - .DE: Germany’s

.deis always one of the best performers, and that remained so, although the dollar volume dropped 19% in the first half of 2023 compared to the same period in 2022. - .ES: Spain’s

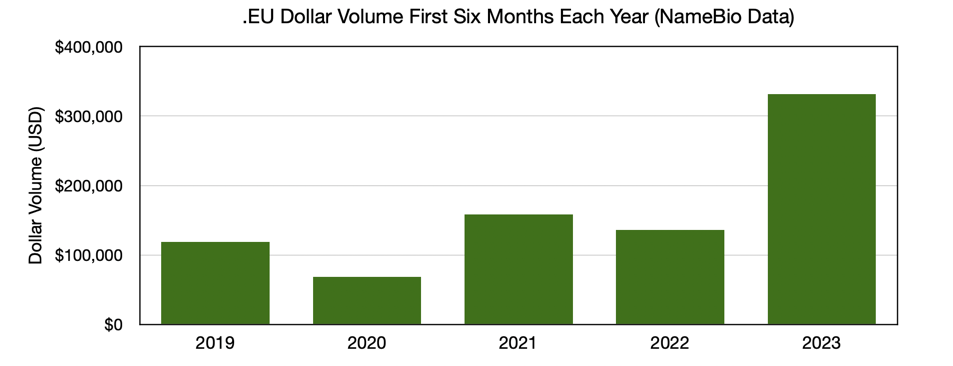

.eswas up 76% in dollar volume. That is the extension’s best showing since 2020. - .EU: Europe’s

.euhad a strong start to 2023, the best in the five years I tracked, growing from $136,000 in the first six months of 2022, to more than $331,000 in dollar volume in 2023. - .GG: Reported sales in

.gg, a country code that appeals to the gaming community, were down 35.6% compared to 2022. - .IN: India’s

.insaw a reported sales volume decline of 18%, when compared to the similar period of 2022. - .LY: The

.lyextension, was down by about 14% in sales volume. - .ME: The

.meextension was down 21.5% in sales volume. It had also dropped last year. - .NL: One bright spot among country code extensions was

.nl, that more than quadrupled dollar volume from the previous year, to $165,000 over the six-month start of 2023. - .TV: The

.tvextension sales dollar volume was down about 19.4%. - .US: The

.usextension was way up last year, but it dropped back in 2023. It is still higher than 2019 and 2020, but 55% down in volume when compared to the first half of 2022. - .VC: The

.vcextension, popular among venture capital firms, saw a 40.7% decline in dollar volume compared to previous year, at least according to NameBio-reported sales.

New Extensions Down

Taken as a whole, new extension sales pulled back strongly compared to 2022, although 2023 was better than 2020 or 2021. The dollar volume in the first six months of 2023 was $1.81 million, compared to $4.85 million during the same period in 2022. The trend over the five years is shown below.

XYZ Drops

After huge increases during the last few years, sales volume in

.xyz dropped by almost 78% when the first half of 2023 is compared to a similar period in 2022.While

.xyz accounts for 38.6% of all new extension volume, that is down substantially from 2022 when it accounted for 65.2%. The graph below shows .xyz over the years.Other New Extensions

Here are comments on some other new gTLDs that I tracked.

- .APP:

.appremains one of the most sold new extensions, and managed to grow dollar volume by 10% when we compare the first half of 2023 to 2022. The dollar volume over the six months was just over $263,000. - .ART: Driven by interest in NFTs, the

.artextension had a superb first six months of 2022, but dropped 28.1% in sales dollar volume in 2023. That still accounted for almost $152,000 in sales. - .CLOUD: The

.cloudextension dollar volume was up 26% when compared to the first six months of 2022, although the total was less than 2019, 2020 and 2021 figures/ - .CLUB: The

.clubextension had been strong in 2019 to 2022, but dropped precipitously in 2023. - .LINK: The

.linkextension is under new ownership. It did manage to more than double dollar volume in 2023, although that is still only just shy of $28,000 over the six month period. - .NETWORK: The

.networkextension had a big rise in 2021. In 2023 it was only slightly changed from 2022, up about 3%. - .ONE: The

.oneextension had its worst start of year, with just $3400 in sales volume. - .ONLINE: The

.onlineextension was up 44% in dollar volume, having its best start of year over the five years. - .SOCIAL: The

.socialextension is popular for Mastodon instances, and other fediverse applications. The sales volume was up more than 5x from 2022, accounting for just over $15,000 in the six month period.

The .biz and .info extensions have both been around for many years.

.bizhad fewer than 50 sales, but based on that decline of 74% in sales dollar volume.- The

.infoextension had 236 sales in NameBio over the 2023 reporting period. Based on that, there was a 24.5% decline in dollar volume.[/b]

Keep in mind that this is a comparison of sales from the first six months of each year only. Economic and world events can have serious impacts in a short period of time. I do a similar analysis published in the NamePros Blog at the end of each year, comparing full year results.

Remember that by no means all domain name sales are reported in NameBio. It is hard to know if there are significant differences between extensions in the fraction of sales that are reported in NameBio.

NameBio reports a higher percentage of wholesale transactions than retail. As wholesale prices have risen, it is likely that a higher percentage of wholesale transactions appear in recent years.

The ratio of number of NameBio-reported wholesale to retail sales varies with extension. While the number of TLDs covered by the standard expired auctions has increased recently, still the expired auctions are dominated by the major legacy extensions, especially

.com.Over the years, what gets reported in NameBio has changed. That impacts the data, although in the period covered I do not know of significant drops in coverage, so it is likely that the decline in sales volume is indeed real.

As for previous reports in this series, I collected the data right at the end of the six month period. That means sales reported later, but that occurred during the six month period, will not have been included. Therefore, you may find slightly different data if you later check NameBio. Since I was consistent in 2019, 2200, 2221, 2022 and 2223, however, there should not be a systematic bias.

Past Years

This is the fifth analysis of the first six months of the year. Here are links to the previous articles:

The decline in sales volume is concerning. While part might be due to declines in wholesale acquisitions, it seems that retail sales overall are in decline. It is possible that venues that typically don’t get reported in NameBio may be taking more of the market.

Please share in the comments below what you conclude from the data. Also, feel free to include mention of additional TLDs that you would like included in future editions of the analysis.

Addition:

I can't do a poll here, but to help assess what percentage of individual retail sales are getting reported to NameBio, could you please complete the poll here.

Huge thanks to Namebio, an incredible resource for domain name sales data.

Last edited: